Automation Transforming Regulatory Reporting and Data Analytics

article2025-04-01

Trump’s so-called "Mar-a-Lago Accord" threatens USD stability, forcing banks to deploy stress tests to mitigate currency, liquidity, and credit risks. Banks must stress test now to avoid being caught off guard by the coming storm.

article2025-04-01

Regulatory reporting is a cornerstone of trust and stability in the financial system, ensuring compliance through accurate and timely submissions. Banks face the challenge of managing disparate data sources, from structured databases to unstructured customer interactions, to meet stringent regulatory requirements such as Basel III, Dodd-Frank, and GDPR. Non-compliance or inaccuracies can lead to hefty fines, reputational damage, or even legal action.

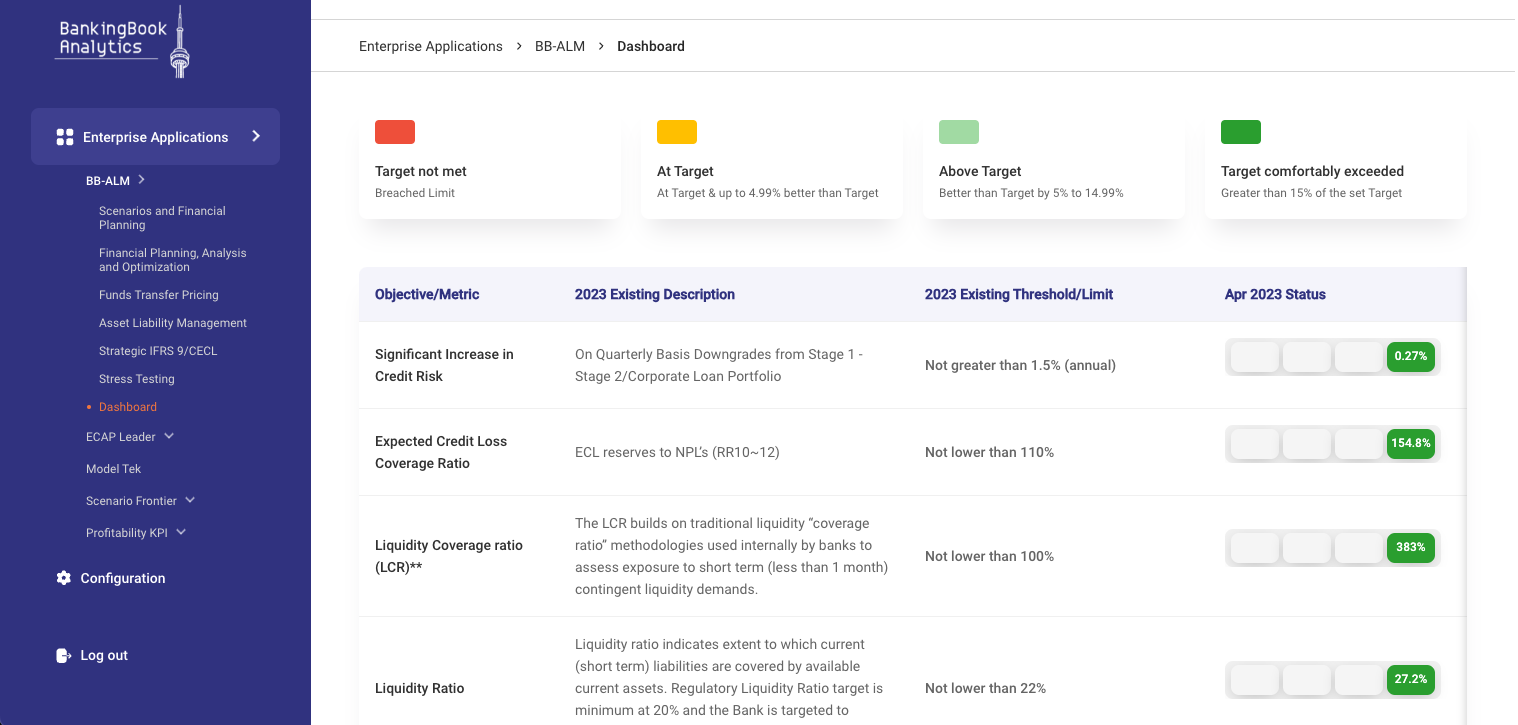

BankingBook Analytics (BBA) offers a transformative solution by leveraging advanced automation, data analytics, and RegTech to streamline the collection, processing, and submission of critical data. Our 3-step approach—secure data upload, customizable reporting templates, and automated notifications—ensures operational efficiency, reduces human error, and enhances decision-making. By focusing on strategic initiatives, BBA empowers banks to stay ahead in a rapidly evolving digital landscape, maintaining trust and stability in the financial system.

article2025-02-15

A financial institution’s balance sheet is more than just a static snapshot of assets and liabilities. When viewed through the lens of risk management, it holds the key to understanding a bank’s exposure to interest rate and liquidity risks. By segmenting and reorganizing the balance sheet, institutions can uncover insights that drive strategic decisions, protecting equity and managing risks in a dynamic market.

In this article, we’ll explore some practical tips on redesigning balance sheets to better identify and measure interest rate risk (IRR) and liquidity risk, while highlighting key metrics that can be leveraged for a more accurate risk assessment.

article2024-10-15

BBA’s gen AI powered ERM solution serves all lines of defense (LODs): business and operations, the compliance and risk functions, and audit. It is designed to provide automated reporting, improved risk transparency, higher efficiency in risk-related decision making, and partial automation in drafting and updating policies and procedures to reflect changing regulatory requirements.

article2024-03-28

In this paper, we describe ALM models’ versions and benchmark BB-ALM, BBA’s proprietary ALM model.

report2024-03-25

The Bank of Canada left its key interest rate unchanged at 5% for the third consecutive timesince July 2023 and as Canada’s inflation rate seems to have reached a plateau, economists consider that a lower rate cycle is about to begin.

newsletter2024-01-12

Interest Rate Risk (IRR) analysis and measurements are commonly obtained from traditional in-house asset liability management (ALM) models, outsourced services or vended models. There are three general ALM model levels: entry, intermediate and advanced.

newsletter2023-11-21

Given risks in the current banking environment, regulators are more aggressively supervising the interest rate risk models. There are two approaches to ALM models validations: i) A full replication of the model being used; and ii) A rigorous testing of the assumptions, calculations and methodology of the subject models.

article2023-11-20

As rates drop, lenders are likely to see a flurry of requests to switch mortgages. Mortgage redemptions could be expensive from many aspects. For starters, a mortgage repayment can leave a lender with out-of-pocket charges,...

article2023-09-30

As central banks continue to struggle with taming the stubborn inflation, there are two plausible near term scenarios for banks, credit unions and other institutions holding interest bearing assets and liabilities

newsletter2023-07-18

The uncertainty caused by global macroeconomic headwinds, combined with on-going pressure triggered by the failure of Silicon Valley Bank require lenders to be more cautious and strategic about how they safeguard and grow their balance sheets.

article2023-07-17

Most banks collect money in the short term and use the resulting funds to make loans in thelong term. But managing the ‘tenor mismatch’ between these assets and liabilities can be achallenge for the treasury...

article2023-05-16

In this environment where retail deposits are more valuable and more expensive, thecompetition for deposits continues to heat up. Banks with liquidity challenges turn topromotional pricing to raise rate-sensitive deposits – a race to the bottom of margins.

newsletter2023-04-12

Financial institutions are faced with several common challenges. Many of these challenges are preventable or controllable, but often result in a lasting value impact.

newsletter2023-02-14

The main objective of IFRS 9 is to identify significant increases in credit risk (SICR) on a timely basis. The standard assumes that the reserves derived using forward-looking Expected Credit Loss (ECL) parameters would adequately offset the loan losses.

case study2023-01-03

Financial crime driven by money laundering has reached global and stratospheric proportions. Funds laundered are estimated to run into trillions of dollars annually, estimated to be between two to five per cent of the world’s GDP.

article2022-12-05

The confluence of macroeconomic and geopolitical factors, such as, inflation, supply chain disruption, higher interest rates, an overheated housing market and Russia’s invasion of Ukraine contribute to the stagflation pressures in Ontario and other Canadian jurisdictions

newsletter2022-10-07

Post-COVID knock-on risk, relating mainly to inflation due to the supply-chain bottlenecks, and Evergrande/China risk manifested relatively higher severity during the 3rd quarter

newsletter2022-07-04

When interest rates change the present value of assets and liabilities also change exposing the banks to interest rate risk. Changes in interest rates do not have the same impact on the discounted value of assets and liabilities since they are not invested to the same terms.

article2022-03-15

With adversity comes innovation. An economic downturn necessitates the impetus to transform business and improve performance. The profit pressures of the current economic downturn have compelled management teams to deliberately develop long-term structural advantages.

newsletter2022-02-22

The amount of Expected Credit Loss (ECL) necessary to support a credit portfolio depends on the probability distribution of the portfolio loss.By using the aggregate credit quality as a proxy for the ECL, the portfolio is subjected to risk arising from the loss of granularity.

article2022-02-01

2022 will be a major turning point for central bank policy, growth, and inflationary pressures.While the environment will be more volatile and challenging, institutional risk appetite will need to be recalibrated in anticipation of risk hotspots and particularly mindful of early warning signals.

article2022-01-17

Most mid-sized and large banks are running the core banking software that is more than 30 years old. In the intervening decades, we witnessed the internet transform the world, commerce move to the mobile device and computing move to the cloud.

article2021-10-16

Core transaction processing engines - or “core banking systems”- are at the heart of IT architecture and are increasingly important not only in terms of pure cost and performance but also in terms of processing transactions in real time, being able to stitch together partnerships with tech companies, e.g., allow API access.

article2021-09-30

The Basel Committee on Banking Supervision (BCBS) has developed two standardized liquidity measures intended to gauge and regulate liquidity risks. The first measure is called the Liquidity Coverage Ratio (LCR) and indicates the short-term liquidity risks.

article2021-07-19

Ontario’s 2020 macroeconomic results tell us that the worst has been avoided. Initial estimates suggested contraction in the GDP by 9.0% vs. 5.7% (realized). Better than expected results can partially be attributed to red-hot real estate market as was evidenced by growth in housing starts.

newsletter2021-06-30

BankingBook Analytics (BBA)’s model-based ICAAP solution is now accredited by Canadian regulatory authorities. Our solution is developed in compliance with the local and international regulatory requirements.

article2021-04-19

In this bi-monthly LI article, I discuss various issues surrounding the different perspectives of managing expected return, i.e., from debt holders and shareholders viewpoints and propose how the two conflicting views can be converged and what tradeoffs are required.

article2021-02-01

Our goal, our vision as a firm is to help mid-sized financial institutions get the control back by developing affordable, customized analytics software in a fundamentally better and more convenient way. The entire experience is aimed at building trust and improving the return on investment. At the start of 2020, we embodied a purpose statement for our firm - articulating what each of us has long felt is our firm’s reason for being

article2020-12-22

This article describes how an advanced testing methodology can protect financial institutions from the risk of unknown shocks by integrating alternative macroeconomic scenarios into their stress testing workflow.

article2020-12-03

This article focuses on developing an approach to determine the impact of COVID 19 on credit portfolios.

article2020-07-21

As the debt forgiveness period winds down, concerns about what happens in the post-debt holiday period begin to emerge. Most financial institutions, including mortgage insurers, offered a three to six month deferral period to retail and non-retail borrowers. According to BBA’s research, an estimated 20% - 40% of the loan book exposure went on payment holiday as a result of the abrupt stop in economic activity.

article2020-02-12

Generally speaking, Canadian credit unions and mid-sized banks are well-capitalized. So, the question really becomes what are the benefits of implementing Economic Capital ECAP system?

article2020-02-12

Digital migration is now a key cost reduction lever for banks and credit unions. In the Post-COVID phase of customer migration from branch to digital, every aspect of face-to-face and voice-to-voice interaction needs to be mapped and evaluated for digitization.

article2020-01-15